Introduction

If your investment journey is towards global diversification, then Africa can be your next stop. Imagine a continent where GDP growth is reaching 5–7%, young populations are driving innovation, and social change is possible through impact investing. But, How to invest in Africa effectively? In this detailed guide we will cover in 4,000 words:

Table of Contents

Come on, drink coffee and go—this journey will be insightful, inspiring, and practical.

1. Why Invest in Africa? (Why Invest in Africa?)

1.1 Powerful development path

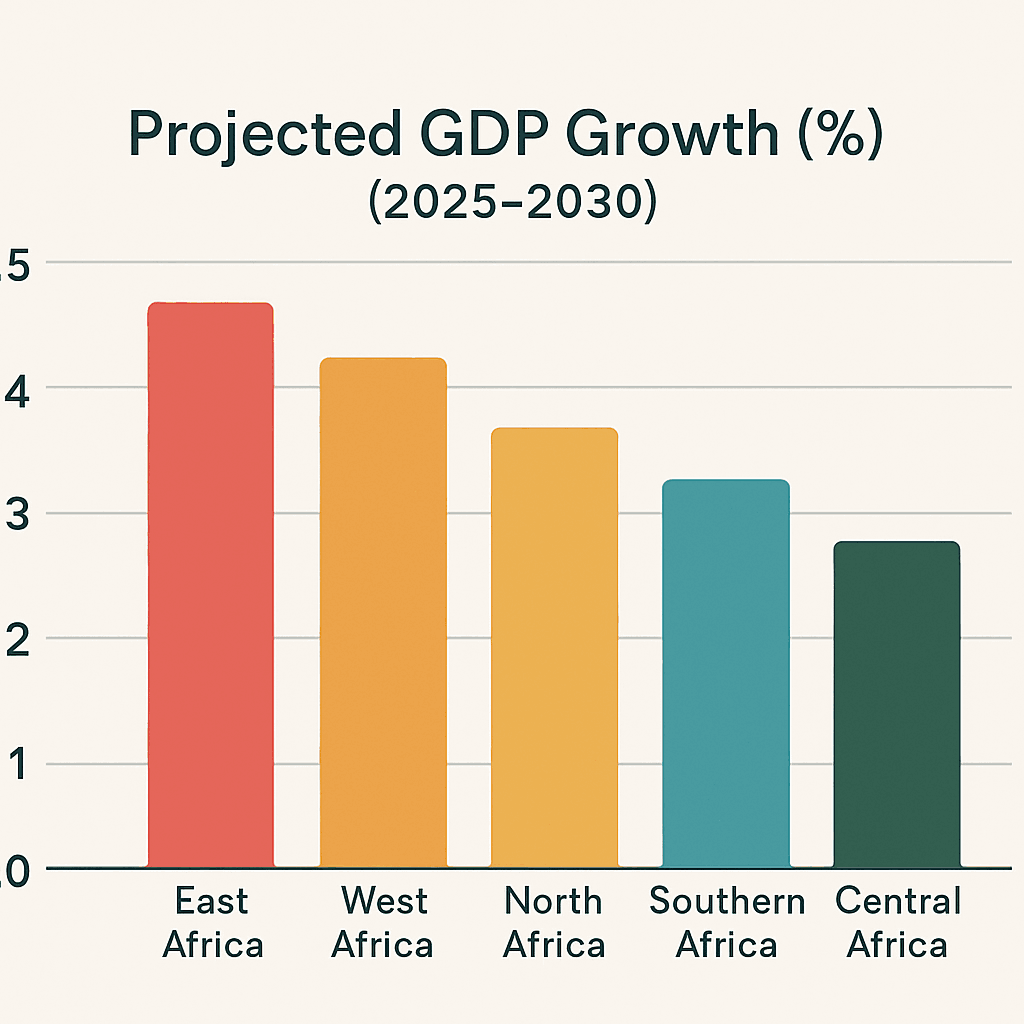

- High GDP Growth: 5%+ GDP growth forecast in 15+ African economies over the period 2025-2030; Madagascar, Tanzania, Ivory Coast, Uganda are shining.

- Youth and Emerging Demographics: Mean age 19; Increasing spending capacity of the middle class.

1.2 Diversification and portfolio flexibility

- High correlation to traditional markets (US, Europe) diversifies the portfolio.

- Inflation hedge through commodity exports (oil, minerals).

1.3 Impact investing and social returns

- Beyond financial returns: clean water, solar energy, upliftment of small-scale farmers.

- Structures such as Opportunity Zones exist for US investors (for example, the Nigeria SEZ).

1.4 Emotional connections and personal stories

I myself invested in a microfinance project in South Sudan—when the local entrepreneur celebrated our support in his first loan repayment, my eyes became moist. Financial returns will reach every mile, but human impact will not reach the heart.

2. Africa’s Economic Outlook (Macro Overview)

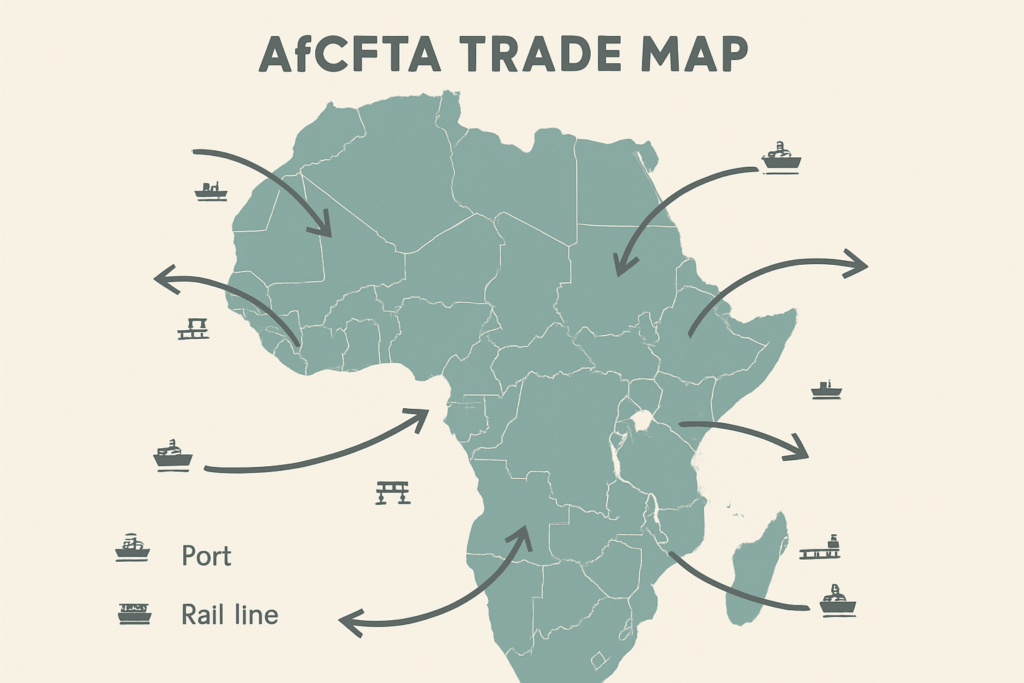

2.1 Regional blocks and trade agreements

- African Continental Free Trade Area (AfCFTA): Largest free trade zone – 1.3 billion population, $3.4T GDP.

- ECOWAS, SADC, EAC: Regional corridors for goods, services, capital.

2.2 Key economic drivers

- Agriculture: Employing 60% of the workforce, 20% of GDP.

- Technology & Fintech: Mobile money has the highest penetration globally (M-Pesa example).

- Natural Resources: Oil (Nigeria, Angola), minerals (DRC cobalt), metals (South Africa platinum).

- Infrastructure Boom: Roads, ports, renewable energy.

2.3 Political and regulatory landscape

- Stability spectrum: Hotspots like Botswana, Mauritius versus DRC, Libya.

- Investment-friendly policies: Ghana’s Ghana CARES, Kenya’s Konza Tech City incentive.

Table 1: Africa macro indicators at a glance

| indicator | 2024 price | 2030 forecast | notes |

| Population | 1.4b | 1.7b | fastest growing region of the world |

| middle period | 19 years | 21 years | youth dividend driving consumption |

| Gross Domestic Product (PPP) | $6.3T | $8.5T | Ranking 3rd globally by PPP by 2030 |

| AfCFTA Partnership | 54 countries | 55+ countries | Near-universal adoption |

| mobile money penetration | 65% adults | 75% adults | Financial inclusion through technology |

3. Sector wise investment opportunities

3.1 North Africa

- Egypt: Suez Canal revenue, tourism rebound, renewable energy (Benban Solar Park).

- Morocco: Automotive Hub, Saur (Nour Ouarzazate).

3.2 West Africa

- Nigeria: Africa’s largest economy – consumer goods, fintech (paystack), oil and gas.

- Ghana: Gold, cocoa, stable democracy, government bonds yielding 10-12%.

3.3 East Africa

- Kenya: Silicon Savanna-M-Pesa, Twiga Foods.

- Ethiopia: Infrastructure PPP, Industrial Park (Hawasa), $500M+ Passenger Bond.

3.4 Southern Africa

- South Africa: JSE-listed mining giant (Anglo American), real estate in Cape Town, renewable IPPs.

- Botswana: Stable, diamond revenue, government bond yields 6-8%.

3.5 Central Africa

- DRC: Cobalt and copper critical for batteries – forest logistics and ESG concerns.

- Cameroon: Agricultural exports (coffee, cocoa), telecommunication development.

4. Investment vehicles: choosing your toolset

4.1 ETFs and public funds

- iShares MSCI Africa ETF (AFK): 60+ holdings in 10 countries.

- VanEck Africa Index ETF (AFK): Tailored for frontier markets.

- Lyxor Pan Africa UCITS ETF (PAF):Listed in Europe.

Table 2: Leading Africa-focused ETFs

| ETFs and tickers | expense ratio | AUM(2024) | Top 5 Holdings | 3-year average return |

| iShares MSCI AFK | 0.84% | $800M | Naspers, Safaricom, MTN, Dangote | 9.1% |

| VanEck Africa AFK | 0.69% | $450M | Naspers, Jumia, BHP, MTN | 8.7% |

| Lyxor Pan Africa PAF | 0.50% | $200M | Siboney, Standard Bank, BUA | 8.8% |

4.2 Direct Equity Investment (Stock)

- JSE: Sasol, Standard Bank, Shoprite.

- NSE (Nigeria): Dangote Cement, Access Bank.

- EGX (Egypt): Commercial International Bank.

4.3 Private equity and venture capital

- Top Funds: TLCom Capital, Partek Africa, Novastar Ventures.

- Ticket Size: $250K-$5M normal; Some angel networks start at $10K.

- Co-investment: Connect with LPs through international funds.

4.4 Crowdfunding and loan platforms

- Lendinghand: Solar Projects in East Africa

- Good: Microloans from $25.

- FarmCrowdy: Nigerian Agritech Funding.

4.5 Real Estate and Infrastructure Fund

- AfricaInvest REIT: Office park in Nairobi.

- IFC Emerging Africa Fund: Infrastructure PPP.

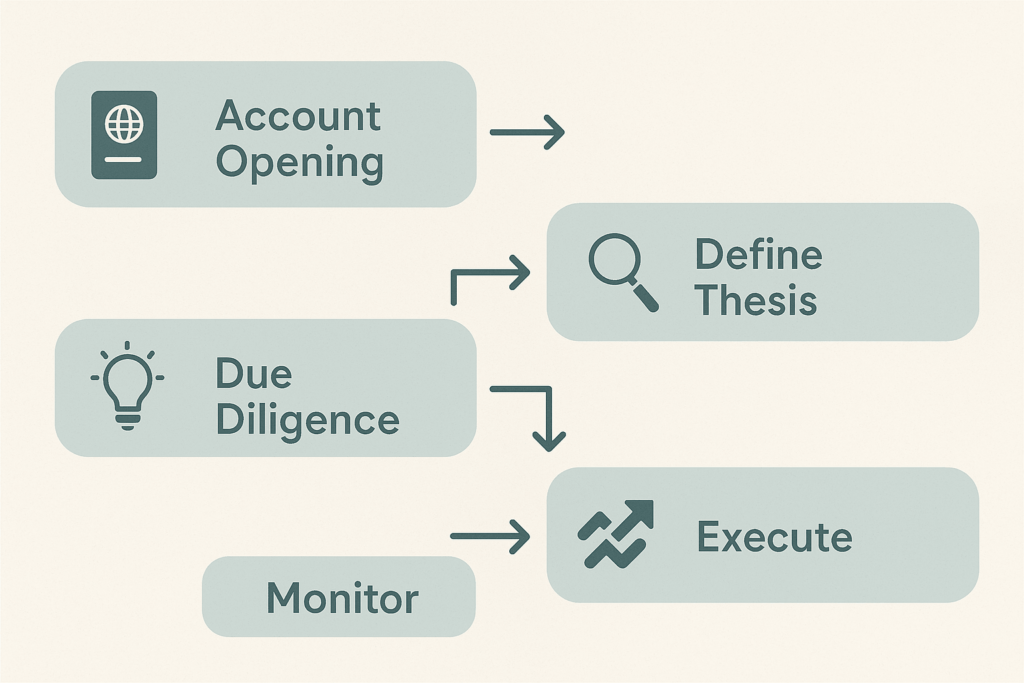

5. Step-by-Step Guide: How to Invest in Africa

5.1 Step 1: Open an International Brokerage Account

- Choose a US broker with global reach (Interactive Brokers, Charles Schwab International).

- Submit KYC: Passport, Address Proof.

- Funds via wire transfer (USD→local currency conversion fee 0.5-1%).

5.2 Step 2: Define your investment thesis

- Sector Focus: Technology, agriculture, commodities.

- Risk Tolerance: Frontier Markets vs. Blue-Chip Stocks.

- time horizon: 3-5 years for development, 10+ years for infrastructure.

5.3 Step 3: Do due diligence

- financial analysis: P/E, ROE, debt ratio.

- ESG and Governance: KPMG’s Africa Corporate Governance Survey.

- Local Partnership: On-ground advisors, regional fund managers.

5.4 Step 4: Execute Your Investment

- Place ETF buy orders during overlap hours (US and African markets).

- Use limit orders to manage the execution price.

- For private deals, negotiate term sheets, carry structures.

5.5 Step 5: Monitor and Manage

- Quarterly Review: GDP updates, currency movements (USD/ZAR, USD/NGN).

- Rebalancing: Trim if a position is >10% of the portfolio.

- Tax Considerations: U.S. FATCA, Foreign Tax Credit on Dividends.

6. Risk Management and Mitigation

6.1 Political and regulatory risk

- Invest in stable jurisdictions (Mauritius, Botswana).

- Use political risk insurance (MIGA, Lloyd’s).

6.2 Currency fluctuations

- Hedge with currency forward or currency-hedged ETFs.

- Keep 10-15% in USD cash buffer.

6.3 Liquidity constraints

- Prefer ETFs for day-to-day trading ability.

- Private Equity Lock-up: Understand the Exit Timeline.

6.4 Fraud and governance issues

- Verify management credentials.

- Third-party audits and transparency reports.

7. Deep Dive Case Studies and Emotional Anecdotes

7.1 Case study: The M-Pesa phenomenon (Kenya)

- Safaricom’s Mobile Money launched in 2007.

- Over 40M users; Drives 35% of Safaricom’s profits.

- US investors holding Safaricom ADRs saw 18% CAGR over 5 years.

7.2 Case Study: Flamingo Gardening (Kenya)

- Export of cut flowers worth $150 million annually.

- Integrated Supply Chain: From Farm to Schiphol Airport.

- Founder’s Story: Starting with 10 hectares, now over 500 employees empowering local women.

7.3 Personal story: Raj’s Agritech victory in Ghana

My friend Raj started a $5,000 investment through the Farmcrowdy platform.

- Annual ROI 12% + Social Satisfaction.

- Local farmers are provided training & market linkages.

8. FAQs: Your Most Common Questions

Q1: Can foreign investors buy stocks easily?

Haan, JSE, NSX, EGX all U.S. Accessible through brokers—only KYC and currency conversion fees have to be seen.

Q2: Why are ETFs low-cost and diversified?

iShares MSCI AFK (0.84%), Lyxor PAF (0.50%) Beginner-friendly, access to 80+ companies.

Q3: What is the minimum investment amount in private equity?

Typically $250K-$1M. Some crowdfunding platforms start at $10K.

Q4: How to avoid currency risk?

Currency-hedged ETFs are used in forward contracts.

Q5: What is the best sector for impact investing?

Renewable Energy & Agriculture High Impact + Strong Returns.

Q6: How about tax treaties and double taxation relief?

U.S. and claim DTAAs—IRS Form 1116 foreign tax credit among 30+ African nations.

Q7: What are Exit strategies?

ETF sales, secondary market for private shares, IPO listings on African exchanges.

9. Conclusion and Call-to-Action

Investing in Africa is not just about financial returns, it is like becoming a part of a new world. Whether you start with ETFs, do direct stock picking, or explore private equity—each step offers potential and impact.

Your next step:

- Open a broker account (Interactive Brokers recommended).

- Start with ETFs after assessing your risk tolerance.

- Find small private deals through crowdfunding.

And most importantly—share the journey! Share your experiences, questions, and stories in the comments. Where am I in the car to answer your question?

ALSO READ

How to Fix Credit After a Car Repossession 2025

Social Security COLA 2025: Your complete guide to the 2.5% increase

RTX Stock Guide 2025: Price, Forecast, Dividend, ESG & Strategies