Introduction

You might be wondering – “How to earn regular money without going to office?” Passive income is the answer. And Best Dividend Stocks for Passive Income 2025 There are ways in which your bank balance will increase every quarter or month. In this article, we will talk in detail about what dividend stocks are, how to choose top picks, which ETFs to consider, how to do tax planning and risk management tips. The entire guide is written in a conversational style, making it feel like a friend talking about investing.

Table of Contents

1. Passive Income and Dividend Stocks: A Quick Overview

Passive income is where you can generate income over and over again by working hard. The most reliable source of passive income in the stock market is dividend stocks. These stocks give you a share of the companies’ profits at regular intervals.

1.1 What are Dividend Stocks?

- Shares received by shareholders from the company’s profits

- Boards of directors of companies decide the dividend amount

- Payment Frequency: Quarterly, Monthly or Annually

1.2 Benefits of passive income

- Regular Cash Flow: Comfortable cushion every quarter/month

- Compound growth: Excess income by reinvesting dividends

- Low Volatility: mature companies, stability

2. Why Dividend Stocks Today?

Amid economic uncertainty and rising interest rates in 2025, dividend stocks are the best hedge. Fixed deposits yield only 3-4% interest, while dividend stocks can yield more than 5-7% if chosen responsibly.

2.1 Inflation protection

Companies increase their dividends by adjusting their prices with inflation. It provides a sustainable income source.

2.2 Increasing your magic

Reinvested dividends grow exponentially over time, also known as the “snowball effect.”

2.3 Practical benefits

Regular payouts help investors develop disciplined reinvestment habits, which helps in building long-term wealth.

3. Dividend Selection Framework

Check these 5 factors before investing in any stock:

- dividend yield (%): I get stable returns in the 3-6% range

- Payout Ratio (%): Ideally <60%, leaving room for profitable reinvestment

- dividend history: 10+ years of stable growth/dividends

- balance sheet health:Low debt, consistent free cash flow

- sector diversification: Healthcare, Consumer Goods, Utilities, REITs, Financials

Pro Tip: It is better to choose moderate yield with strong fundamentals rather than chasing high yield, as extremely high yield is a red flag for risky companies.

4. Top 10 Dividend Stocks for Passive Income 2025

Here we are listing 10 best dividend stocks that will give you steady passive income in 2025.

| anchor | company | Sector | dividend yield (%) | Payout Ratio (%) | Dividend Growth (5Y CAGR) |

| MRK | Merck & Company | Health care | 2.9 | 43 | 6.5% |

| KMB | kimberly-clarke | consumer goods | 3.2 | 65 | 5.2% |

| Passion | PepsiCo | consumer staples | 2.8 | 66 | 7.1% |

| tgt | Target Corporation (Aristocrat) | retail | 2.5 | 49 | 6.8% |

| uhhh | UnitedHealth Group | Health care | 1.5 | 18 | 12.3% |

| Realty Income (Monthly) | REIT | 4.5 | 80 | 4.4% | |

| deer | STAG Industrial (Monthly) | REIT | 5.1 | 90 | 3.8% |

| abbv | AbbVie | Health care | 4.2 | 85 | 15.6% |

| D | Dominion Energy | utilities | 4.0 | 70 | 4.1% |

| Is | coca cola | consumer staples | 3.0 | 71 | 5.8% |

Data updated April-May 2025

5. Case Study: Raj’s Portfolio Journey

Raj invested $10,000 in dividend stocks in 2012.

| year | initial investment | dividend income | portfolio value |

| 2012 | $10,000 | $350 | $10,350 |

| 2015 | — | $600 | $12,500 |

| 2020 | — | $1,200 | $18,200 |

| 2025 | — | $2,300 | $28,000 |

Raj reinvested the dividends, adding to both portfolio value and income. Today its dividend is providing $2,300 annually without any additional deposits.

6. ETF vs Direct Stock: Which is Better?

| Speciality | direct dividend stock | dividend etf |

| Diversity | Manually selects 5-10 stocks | 50-100+ stocks automatically diversified |

| research efforts | High (checking earnings, balance sheet) | LOW (ETF Provider Handles Selection) |

| Cost | Brokerage fee per trade | Expense ratio (~0.2%–0.5%) |

| Income frequency | Depending on stock (monthly/quarterly) | usually quarterly |

| ideal for | experienced investor | Beginner or experienced investor |

Popular Dividend ETFs:

- Great (ProShares S&P 500 Dividend Aristocrats ETF) – 2.5% yield, Aristocrats Focus

- SDY (SPDR S&P Dividend ETF) – 3.0% yield, mid-cap emphasis

7. Dividend Stocks That Pay Monthly

If you want monthly cash flow, these options are best:

| anchor | company | Sector | yield (%) | Payout Ratio (%) |

| realty income | REIT | 4.5 | 80 | |

| deer | STAG Industrial | REIT | 5.1 | 90 |

| main | main road capital | bdc | 8.0 | 105 (high risk) |

| LTC | ltc properties | REIT | 6.2 | 75 |

Warning: Payout ratio >100% indicates the company is paying more than it earns – risky long term.

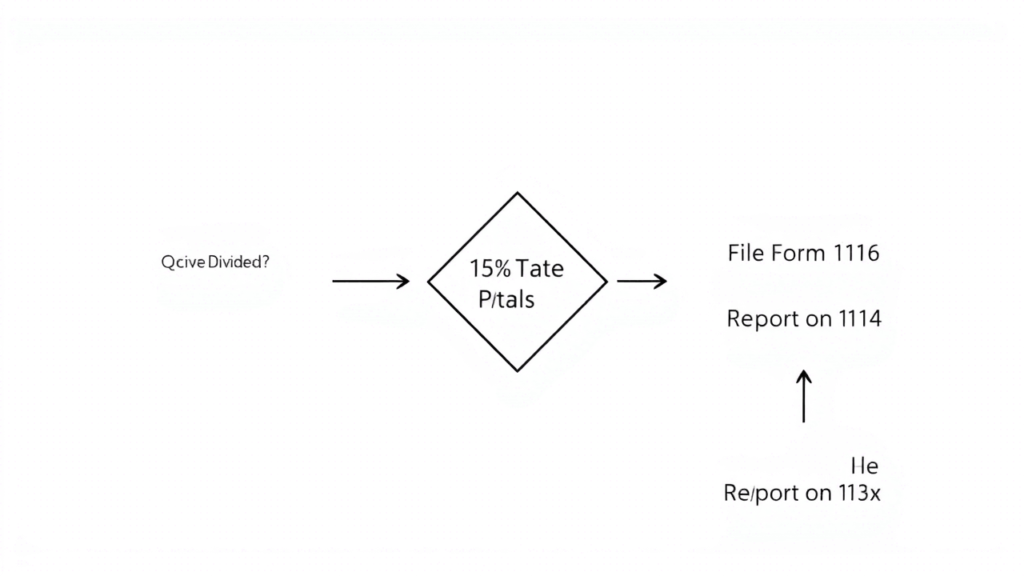

8. Tax planning for dividend income

- Qualified vs. Non-Qualified Dividends

- Eligible: 15% taxed (long term)

- Non-eligible: Taxed at your normal bracket

- tax-advantaged accounts

- Roth IRA, Traditional IRA, 401(k)

- state tax

- No tax on dividend income in some states. Check your state’s laws.

- foreign dividend withholding

- International Stock Equals 15-30% Withholding – File Form 1116 for credit.

9. Platform Selection: Brokerages for US Investors

- Loyalty: Zero Commission, Fractional Shares, Research Tools

- Charles Schwab: Low expense ratio, helpful customer service

- TD Ameritrade: Strong Trading Platform, Thinkorswim

- Robin Hood: User-friendly, instant deposits (entry level)

10. Risk Management and Exit Strategy

- Monitor payout ratio quarterly: Safe with Agar <40%, >70% Caution

- see increase in income:decline in EPS = potential dividend cut

- Set stop-loss/profit targets

- Rebalance annually: Sector load will be checked and rebalanced.

11. Anecdotes and emotional touch

My mom always said, “Seta, have an emergency fund.” When lockdown came in 2020, his dividend portfolio gave him $300 in cash every month – more comfort than his own salary. That feeling is priceless when you know your portfolio is working even while eating money.

12. Frequently Asked Questions (FAQ)

How to know if a dividend is sustainable?

Check payout ratio (<60%), free cash flow stability, earnings stability.

Are monthly dividend stocks better?

If you need cash for living expenses or bills, monthly is best. The quarter is also good for reinvestment.

When should I sell?

If the payout ratio is unstable (>.80), income declines or debt increases.

Why should you consider international dividend stocks?

Additional diversification, higher yields. But keep in mind currency risk and withholding taxes.

Are ETFs better or direct stocks?

ETFs for beginners, straightforward choices for professionals.

13. Conclusion and call to action

Now you have a detailed roadmap Best Dividend Stocks for Passive Income 2025 the journey takes. Start by opening a brokerage account and investing $500-$1,000. Track your dividends each quarter, reinvest them and rebalance your portfolio to ensure optimized returns.

Next Steps:

- Open an account at Fidelity, Charles Schwab, or TD Ameritrade

- Invest in 3-5 stocks in ETFs

- Set calendar reminders for quarterly reviews

ALSO READ

debt consolidation vs debt settlement pros cons 2025

Small Cap ETF Investing 2025 best guide

Best Forex Trading Platforms for Beginners in the USA | Ultimate Guide