Introduction

Have you ever wondered how to reduce your debt burden? If you’ve ever googled debt consolidation vs debt settlement, you’re not alone. Today we will talk about both of these solutions, their advantages and disadvantages, and see how you can reset your financial life. By the end of this guide, you’ll have clarity on which path suits you best—and how to start taking control today.

Table of Contents

Understanding the Basics

Whenever there is talk of debt management, first of all it is important to understand that debt consolidation vs debt settlement Both strategies can get you to a better financial position—but in different ways.

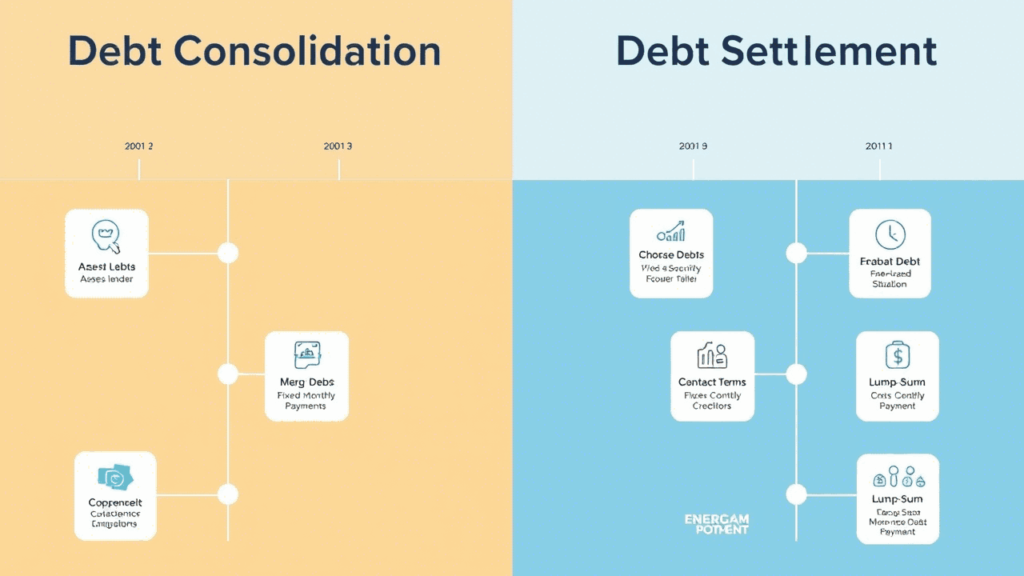

- Debt Consolidation: Merging multiple high-interest debts into a single loan with a lower interest rate.

- Debt Settlement: Negotiating with lenders to reduce your outstanding balance, so that settlement can be achieved through lump-sum payment.

In the next sections we will explore both of them in detail, along with pros and cons.

Debt Consolidation Explained

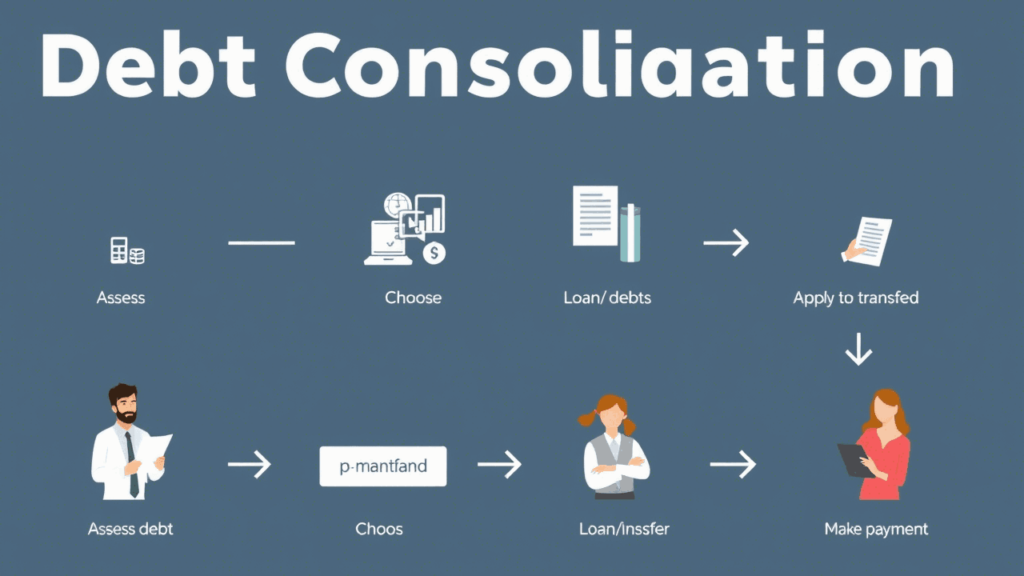

What Is Debt Consolidation?

Debt consolidation is a process where multiple debts—like credit cards, personal loans, medical bills—are combined into a single loan or credit account.

Common Methods of Consolidation

- Balance Transfer Credit Cards: Zero-percent introductory APR for 12–18 months.

- Personal Consolidation Loans: Fixed rate, fixed term, predictable payments.

- Home Equity Loans / HELOCs: Secured by home, lower interest but risk of foreclosure.

Pros of Debt Consolidation

- Simplified Payments: One due date and one EMI.

- Lower Interest Rates: Especially with secured loans or promotional cards.

- Credit Score Boost: Timely payments help FICO score over time.

Cons of Debt Consolidation

- Qualification Requirements: Good credit score needed for best rates.

- Fees & Costs: Balance transfer fees (3–5%), origination charges.

- Risk of More Debt: Old accounts might remain open, tempting overspending.

Debt Settlement Uncovered

What Is Debt Settlement?

Debt settlement mein aap directly creditors se negotiate karte hain to reduce the principal amount owed. Settlement companies often charge fees of 15–25% of the settled debt.

Settlement Process

- Stop paying creditors directly and let money accumulate in a dedicated account.

- Once savings reach about 30–50% of total debt, negotiate a lump-sum settlement.

- Pay reduced amount; creditor reports “settled for less than full balance” to credit bureaus.

Pros of Debt Settlement

- Reduced Principal: Save up to 40–60% on total debt.

- Faster Exit: Complete settlement in 24–48 months vs longer payoff schedules.

Cons of Debt Settlement

- Credit Damage: Settlements show up as negative on credit report.

- Taxes on Forgiven Debt: IRS may treat forgiven amount as taxable income.

- Fees & Scams: Predatory settlement companies may exploit vulnerable consumers.

Head-to-Head Comparison

| Feature | Debt Consolidation | Debt Settlement |

| Credit Impact | Gradual improvement with on-time payments | Significant drop, then slow recovery |

| Interest & Fees | Lower interest; transfer/origination fees | No more accruing interest; settlement fees |

| Duration | 2–7 years | 1.5–4 years |

| Eligibility | Requires decent credit score | Available with poor credit |

| Tax Implications | No taxable forgiven amount | Forgiven debt may be taxable |

| Monthly Payments | Fixed EMI | Lump-sum negotiation, then occasional fees |

Key Factors to Consider

When choosing between debt settlement vs consolidation, consider these:

- Credit Score

- Good Score → Lean toward consolidation

- Poor Score → Settlement might be only option

- Good Score → Lean toward consolidation

- Debt Amount & Types

- High-Interest Credit Cards → Consolidation loans shine

- Large Medical Bills / Unsecured Loans → Settlement could save more

- High-Interest Credit Cards → Consolidation loans shine

- Ability to Save

- If you can sock away cash for settlement, negotiation becomes feasible.

- If you can sock away cash for settlement, negotiation becomes feasible.

- Time Horizon

- Longer roadmap? Consolidation offers steady path.

- Shorter payoff goal? Settlement accelerates closure.

- Longer roadmap? Consolidation offers steady path.

- Tax & Legal Considerations

- Consult a tax professional if using settlement to understand IRS implications.

- Consult a tax professional if using settlement to understand IRS implications.

Real-Life Anecdotes

“I remember, when I was juggling three credit cards at 22% APR, there was not much left after paying the minimum payment each month. Debt consolidation dropped my rate to 10%, and I cleared it all in the main ten years.” – Raj, San Francisco

“My sister negotiated with her credit card company after saving ₹2 lakh rupees in 18 months. The total debt in settlement increased from ₹5 lakh to ₹3 lakh, and we arranged the money comfortably.” – Snow, New York

These personal experiences highlight that there’s no one-size-fits-all solution—your unique situation will guide the way.

Implementation Steps

Step 1: Evaluate Your Financial Picture

- List all debts: balances, rates, due dates

- Track monthly income vs expenses

Step 2: Calculate Savings & Budget

- Can you afford consolidation EMIs?

- Can you accumulate 30–50% of debt for settlement fund?

Step 3: Research & Compare Options

- Compare personal loan offers, balance-transfer cards

- Interview reputable debt settlement firms (check FTC complaints)

Step 4: Make the Choice & Act

- Apply for consolidation loan or balance-transfer card

- Or open a dedicated savings account and start funding settlement

Step 5: Monitor & Adjust

- Set calendar reminders for payments

- Track progress quarterly; refinance or renegotiate if needed

FAQ

Q1:

What’s the difference between debt consolidation and debt relief?

Debt consolidation involves combining debts into one loan at a lower interest rate, while debt relief (often used interchangeably with settlement) negotiates to reduce the principal owed.

Can I do both consolidation and settlement?

Generally, no. Consolidation requires ongoing payments, whereas settlement relies on stopping payments temporarily to build a negotiation fund. Mixing them can confuse lenders and hurt credit further.

Will debt settlement show up on my credit report?

Yes—settled accounts are marked as “Paid settled” or “Settled for less than full balance,” which negatively impacts your credit score.

Are there any hidden fees with consolidation loans?

Watch for origination fees (1–5%) or annual fees on balance-transfer cards. Always read the fine print.

How long does it take to recover my credit score after settlement?

Typically 2–4 years of on-time payments to rebuild, depending on other credit activity.

Conclusion & Call-to-Action

Have you ever thought about looking at your work from a new perspective? Whether you choose debt consolidation vs debt settlement, the most important step is—action. Evaluate, plan, and take control. Every journey is divided by small decisions.

Call-to-Action: Ready to take the first step? Download our free Debt Decision Worksheet to map out your debts and budget, and share your story in the comments below. Let’s support each other on this path to financial freedom!

ALSO READ

Small Cap ETF Investing 2025 best guide

Best Forex Trading Platforms for Beginners in the USA | Ultimate Guide