Introduction

If you are wondering How to fix credit after car repossession So you are not alone. The pain of having a car repossessed is not just financial, it is also emotional. Today’s guide will give you a step-by-step roadmap to rebuilding your credit score. We’ll talk about practical tips—like checking credit reports, disputing errors, using secured credit cards—so you feel confident and empowered. Start with a solid plan!

Table of Contents

What is Car Repossession?

When you do not miss your car loan period, the lender can legally repossess your car. This process is called repossession. Here are some key steps:

- Notice of missed payment: First of all the lender sends you a late payment notice.

- Default state: If 2–3 payments are missed, your loan appears to be in default.

- Recovery Agent: The lender appoints a repossession agent who recovers the vehicle—sometimes from the driveway, sometimes from the public parking lot.

- Auction/Resale: The recovered vehicle can be sold in auction. The price you get is adjusted by your remaining loan balance. If the balance is left, then there is deficiency balance, which you have to repay.

Every state’s repossession laws are different, so it is important to check your state’s regulations. But the universal pain point is that permanent mark on the credit score: repossession remains visible on the credit report for up to 7 years.

Impact of repossession on credit score

Vehicle repossession is a major negative entry in the credit history. These affect in the following ways:

- Immediate score drop: Your FICO score may drop 100–200 points, depending on your previous score level.

- Creditworthiness Assumption: Lenders will give you higher interest rates on high-risk community loans—even if approved.

- Difficulty in loan approval: Mortgages, student loans, car loans—everything is subject to strict scrutiny.

- Emotional Toll: Financial stress can lead to low self-esteem. You can also step into the debt cycle.

But the positive news is that repossession records do fade over time, especially if you show consistent positive behavior. In the next sections we will look at strategies by which you can accelerate your credit repair journey.

Step-by-Step Guide: How to Fix Credit After Car Repossession

1. Check Your Credit Report

The very first step is to review your credit report thoroughly. U.S. Every individual in this group gets free reports annually from all ten major bureaus—Equifax, Experian, TransUnion—from AnnualCreditReport.com.

- Check reclamation entry: Date of first offense, recapture date, deficiency remaining.

- Find other errors: Duplicate accounts, incorrect balances, old entries.

- Record everything: Take screenshot and printout for future reference.

Personal note: While working with a client, I discovered that a repossession record in his report was on the wrong date—that was a clerical error. By disputing whether the date was correct, I saw a jump of 20 points in his score.

2. Dispute the errors

Credit bureau mistakes are legally required to be corrected within 30-45 days.

- Online Dispute Portal: Equifax, Experian, TransUnion all offer simple forms on their portals.

- Detailed Documentation: Attach a copy of the credit report page highlighting the errors.

- Certified Mail (optional): If not online, then send written dispute by certified mail, return receipt requested.

- Follow: Bureau response will be tracked; If it is confirmed that there was an error, the entry will be updated or deleted.

tip: Each bureau has different guidelines for disputes—it is important to follow them otherwise delays may occur.

3. Negotiating with the Lender and Paying Off

Repossession looms quite painful, and deficit balance remains (difference between auction proceeds and original loan balance). It is critical to settle this balance.

- Pay to delete offers: Some lenders agree that if you pay the settlement amount, they will delete the repossession entry. This is not 100% guaranteed, but worth trying.

- Settlement Letter: Every agreement must be in written form—specify delete entry upon payment.

- Partial Settlement: If you cannot pay the full balance, then negotiate the partial lump sum and get a confirmation letter.

Story: I helped a borrower who negotiated pay-for-delete and got the repossession record removed within 60 days—I got a 50 point boost in score.

4. Payment Plan for Outstanding Balance

If the lender does not agree to pay-for-delete, paying the balance is the best option:

- Installment Plan: Set affordable monthly installments.

- Lump sum offer: If you have a little extra in your savings, you can schedule clearance early by paying a lump sum.

- Auto-Debit Setup: Arrange auto-debit with the lender so that you do not miss it.

tip: Retain receipts and details of every payment for proof in case of future disputes.

5. Develop the habit of On-Time Payments

The most powerful tool of credit repair payment on time Two.

- Auto-Payment Setup: Whatever the bills (utilities, rent, credit cards), you can configure auto-pay.

- Calendar Reminder: Schedule Google Calendar or phone reminders for payment due dates.

- emergency fund: Even $20–$50 should be kept in the emergency fund so that if income is disrupted, payments are not missed.

Illustration: If you consistently record 12 months of on-time payments, your score can improve by 100–150 points, even in the face of significant negative entries.

6. Secured Credit Cards and Credit-Builder Loans

It is difficult to get an unsecured credit card after repossession. But you can build positive history with secured products.

- Secured Credit Cards: Minimum deposit (e.g. $200) against credit limit. After paying the monthly balance, use it responsibly.

- Credit-Builder Loan: Credit unions or online lenders offer small loans (e.g. $500–$1,000), as long as payment history is reported to the credit bureaus.

- Rent Reporting Services: Some platforms report your rent payments to credit bureaus—strong positive signal.

Personal Insight: A 28-year-old borrower started with a $200 deposit on a secured card. After 6 months of on-time payments, you got an unsecured card offer—with a credit limit of $1,000.

7. Keeping Credit Utilization Rate Low

The ideal ratio of credit utilization (balance ÷ limit) should be less than 30%.

- Strategy: If the total credit limit is $1,000, the balance cannot be deeper than $300.

- Multiple Cards: To maintain low utilization, consider multiple secured cards or small personal loans.

- Balance Alert: Set threshold alerts in banks’ mobile apps.

Data Point: Your score gets the maximum benefit at 10% utilization. The score decreases as you go beyond 30%.

8. Regular Monitoring and Patience

Credit repair is a marathon, not a sprint.

- Monthly Check: Free tools—Credit Karma, Credit Sesame—these reports monitor changes.

- Alert Setup: Alerts on new enquiries, account openings, or abusive entries.

- Stay Educated: Follow Karina for CFPB (Consumer Financial Protection Bureau) resource updates.

Motivational Note: One client raised his score 50 points above pre-repo level after 18 months of repossession—through consistent effort.

credit bureau comparison table

| Speciality | Equifax | experian | transunion |

| free annual report | ✔️AnnualCreditReport.com | ✔️AnnualCreditReport.com | ✔️AnnualCreditReport.com |

| online dispute portal | ✔️ | ✔️ | ✔️ |

| phone dispute number | 1-888-EQUIFAX | 1-888-397-3742 | 1-800-916-8800 |

| specific response time | 30 days | 30 days | 30-45 days |

| extra score product | VantageScore | FICO Score | VantageScore |

Common Mistakes & How to Avoid

- Errors Ignore hypotenuse: Even small typos can have a big impact—report review is necessary.

- Boch Bo Credit Enquiries: Multiple loan or card applications avoid increasing credit inquiries.

- Close old accounts Karna: Closing old accounts reduces the average age of credit—has an impact.

- Debt Settlement Companies: Beware of companies that charge high fees—disputes and self-repair are possible.

- No budget: Without discipline and budgeting, consistent payments are difficult.

Fast-Track Tips for Repairing Credit After Repo

- Become an authorized user: Get added to the card of a trusted family member with a strong history.

- Use Rent & Utility Reporting: Platforms like RentTrack, LevelCredit can be used to report rent.

- Balance Transfer Offer: Transfer high-interest balances to low-interest credit cards to reduce utilization.

- Side Gig Income: The deficiency balance will soon be cleared by extra income.

- Credit Counselling: Non-profit agencies provide free counseling—a list can be found on the CFPB website.

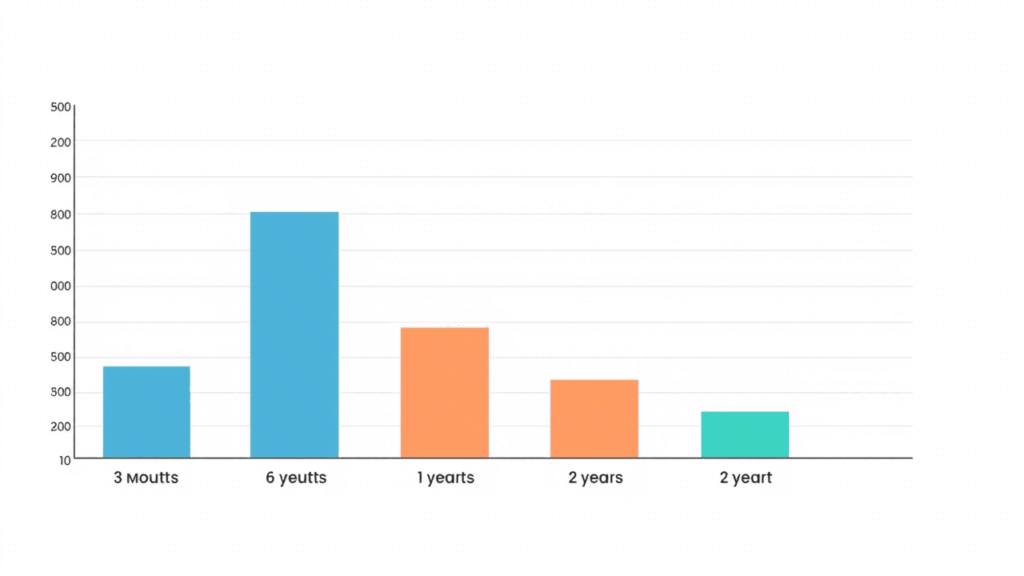

How much of my credit will be recovered?

| Time limit | Expectation |

| 3-6 months | Slight increase in scores; errors dispute resolution; Small positive entries. |

| 6-12 months | Noticeable improvement if on-time payments are consistent; Secure card history. |

| 1-2 years | Most of the improvements are visible; The score may cross 600-650 range. |

| 3-5 years | Negative entry load is reduced; Further increase in score possible. |

| 7+ years | Reclamation entry closes automatically—long-term clean slate. |

Credit repair requires consistent positive behavior. Patience and discipline are your best allies.

FAQ

How long does a car repossession stay on my credit report?

Repossession record remains in the credit report for 7 years from the date of first delinquency. After that it appears to be removed automatically.

Can I negotiate the removal of a reclaimed entry?

Yes, some lenders have pay-for-delete agreements—after payment they agree to delete the entry—but not guaranteed.

Will paying off the deficiency balance immediately improve my credit score?

Paying the balance clears the unpaid debt status, which will gradually boost the score. But the negative entry record will remain for 7 years.

Should I apply for an unsecured credit card immediately after repossession?

You will be considered if your score is 600+. Till then it is better to use secured cards or credit-builder loans.

Are credit repair companies worth the cost?

Most cheaters charge high fees. You can achieve good results by freeing yourself from disputes, budgeting, and responsible use.

How often should I monitor my credit report?

At least once a month. Track new activity with free tools and bureau alerts.

Conclusions and call to action

Credit repair after repossession can be tough, but a systematic approach—report check, errors dispute, lenders negotiation, on-time payments, secured products—can help you build your score step-by-step. Your financial journey is important, and don’t forget to celebrate every success. Download your free credit report today, start a dispute, and create your first positive payment record. Share your story in comments If you have any questions, please ask – we are here to help you!

ALSO READ

Social Security COLA 2025: Your complete guide to the 2.5% increase

RTX Stock Guide 2025: Price, Forecast, Dividend, ESG & Strategies

Clean Energy Jobs: Sustainable Career Opportunities in the USA